✨Sippin’ Lattes & Shaking Off Debt: Welcome to My Savings Surge Era ✨

PSA, bestie <3

This post may have affiliate links, which means I could earn a lil’ cash money if you decide to snag something I mention (at no extra cost to you, of course!). It helps keep this blog running and my caffeine options fully stocked!! ☕️✨ I only link stuff I genuinely love and would 1000% drop in the group chat.

Over the past few months, like many, money has been at the top of my mind. With the economy, inflation, living in a high cost living area like Los Angeles, AND dealing with literally thousands of dollars in medical expenses, I find myself wondering how to better use my funds.

Quick story time (I promise - I think…) Back in 2018, I was knee deep in debt. I had about $10,000+ of credit card debt due to a pyramid scheme. To be fair, I was desperate. I was sold on the “healing” nature of the products and the medical field had failed me so many times. I was willing to pay and I was vulnerable. (more on that later) On top of that, I had a car & student loans. *sighs in millenial*

In January 2019, I decided something needed to change. I needed to get my finances in order. So, I busted out my spreadsheet, mapped out my spending and found ways to save. I entered what I’m calling the …….. *drumroll*

✨SAVINGS SURGE ✨

My goal was to find ways to save that were intentional &&& manageable! Any extra savings was thrown at my credit card and car loan debt but I didn’t sacrifice the things I valued, like travel and going out to eat.

🎶“Can’t stop, Won’t stop groovin’”🎶

Before I give you my top SAVING SURGE ideas, I want to highlight a few things:

✨Money Mindset✨

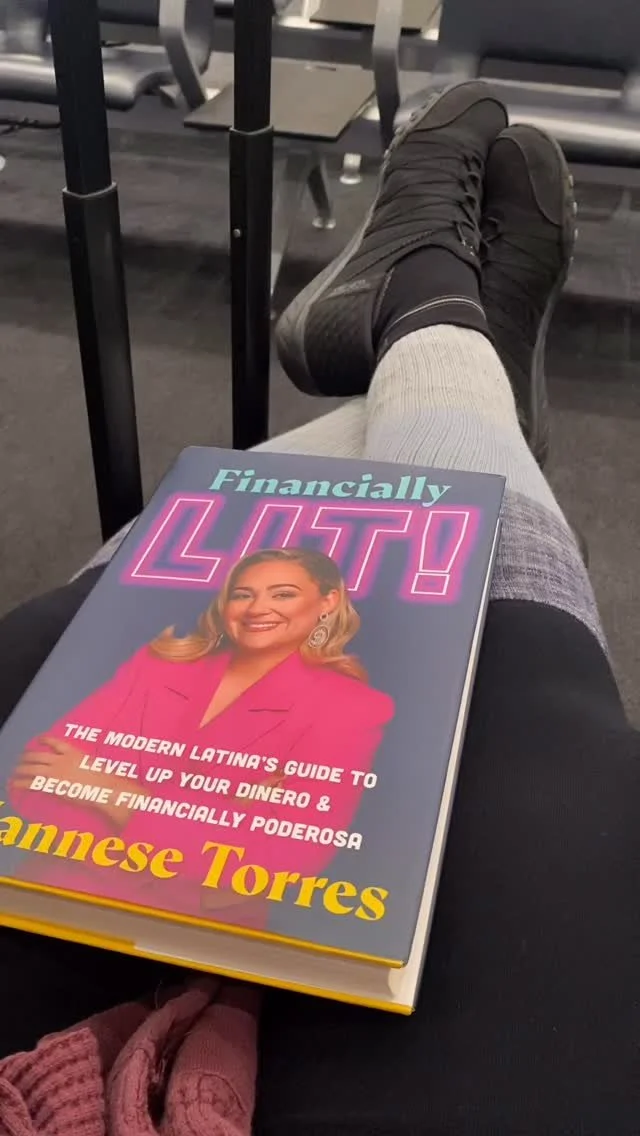

I knew that if I didn’t get my mindset right, I would end up impulse buying ALL. THE. THINGS. and end up back in debt. During my SAVINGS SURGE, I started listening to financial educators that reflected me and my interest. I wanted to hear what these educators had to say on debt payoff and savings. Some suggestions were a great fit for me - others, not so much. I guess that's why they call it personal finance. ;)

For example, techniques like “no spend” days/weeks/months may work for some. With my ADHD impulsivity, I would finish a “no spend” and then drop a BUNCH of money on random stuff chasing that dopamine all the way back to credit card debt. Restriction only made my impulse shopping WORSE. So instead, before I made a purchase, I’d ask myself the following questions (I literally had to put a note on my phone with these questions as a reminder. (At one point, I had a screenshot on my phone lock screen so I had to look at it everyday):

Does this purchase help me accomplish my financial goals?

Is there a free/cheaper option for this purchase?

Will this purchase provide value? If so, what kind?

Can this purchase wait a day? Week? Month?

Is this purchase worth delaying my debt payoff goal?

How many hours would I have to work to purchase this item?

Do I want to move this purchase in a year? (I literally moved almost every year & the thought of packing up and moving an item was a REALLY big factor for me.)

Asking these questions, I found that I didn't need or want most of the things I was spending my money on. My impulsive purchases went WAYYYYYY down and I was able to accomplish my goals faster.

THIS. BOOK. by Tori Dunlap is incredible and is rooted in a healthy money mindset.

Highly recommend!!!! Check out your local library to see if you can check it out!

✨Breakfast Burrito Budget ✨

It’s okay to spend money. *I whisper to myself* Over the years, I’ve really felt the guilt & shame of spending MY OWN money. (Ummm - NO QUEEN!) I was heavily influenced by toxic narratives like “you’re broke because you spent $7 on that latte.” ummmm… no sir! I need the caffeine to do the words into sentences thing and human…. Ya, know? (Sidenote: This toxic narrative is partly why I chose the name “Off To Get Coffee” because I will become wealthy AND drink my $10 latte whenever I please - mk!!!! Thank you very much!!)

A quick story….

Breakfast food is my FAVORITE!!! I could eat breakfast food LITERALLY anytime but I especially need breakfast in the morning before work. If you’ve spent a day with me, you’d know that I am NOT a morning person. (like I’m literally writing this at midnight and probably will be up for another hour or so.) I tell people I rise with the moon. Mornings are ALWAYS a scramble (he he scramble) and they are the hardest part of my day. My brain just doesn’t lock in till much MUCH later.

Anyway, there was a cafe in my office building that sold a good breakfast burrito. When I looked at my expenses, I realized that my breakfast burrito habit was MUCH more expensive than I expected. After some reflection, I realized that breakfast burrito fuels me. It’s an enjoyable experience that nourishes my body and helps me excel during the day. That burrito set me up for success.

Now, you may be thinking “Why don’t you just pre-make breakfast burritos and take them into work?” The reality is - I won’t eat them. They will sit in the freezer and get tossed when I move out. It’s the cost of ADHD. I will NEVER remember they are in the freezer. ALSO, I'm not a fan of the texture of microwaved burritos. But when I entered the building and saw my knight and shining burrito, I knew I was saved from a morning of hunger. It works for me - and that’s what matters!

During this savings surge, I decided to have a breakfast burrito “budget” because it added too much value to my life, health, and well being. It became a requirement. Again, It’s okay to spend money, especially when it's based on your personal values & goals.

✨Make it FUN!!! ✨

When I shared this savings idea with my friends, they jumped on the support train so fast! If you can find ways to make your money fun, you’re more likely to stick with it and have a more enjoyable experience. Inviting my community to join my savings challenge was one of the best things I could've done because we learned to save together.

I actually wrote a whole post on My Money Dates where I get myself amped to tackle my money goals! Check it out for some fun ideas!

What crazy fun ideas do you have to make savings fun?

✨There’s a reason it’s called a SURGE ✨

While I still implement many of the saving surge ideas, I allowed myself to change, add, or completely nix any ideas that no longer served me. The surge isn’t meant to be restrictive but to help you accomplish your goals in an intentional, mindful way. Once I accomplished my goal, I eased up on certain things but still focused on spending money on my personal values and goals.

For example: During the surge, I decided to spend money on travel but I found more affordable ways to do it. For example, I booked flights with credit card points, traveled on off season, and booked free or cheaper amenities. When I accomplished my goal, I eased up and booked a more comfortable seat on the flight or booked a fancier hotel. (The legendary @RickStevesEuropeOfficial , a travel guide creator, has some great resources for traveling with different budgets!)

For you athletes out there, it’s kind of like preparing for a big race, game, or whatever. You dedicate your time, mind, & body for the big day. Once your big event is over, you take time to rest, relax, and recuperate. You worked hard and you deserve to celebrate!

✨You can’t save your way into wealth. Finding ways to earn more is KEY. ✨

About two years after I started my savings surge, I paid off all of my credit card debt and my car loan!!!!!!!!!!!!!!!!!!!!!

AWKA-believe it!!!!!!!!!!!!!

I became confident in the methods I was using and proud of staying dedicated to my financial goals. I am proud of what I was able to achieve. I showed myself I was capable of learning new skills and accomplishing my goals!

If I wanted to reach my next financial goals, I had to earn more money. So, I acquired new skills and built professional relationships to get a higher paying job. This launched me into my 🔥 FI/RE era aka Financially Independent/ Retire (or Rest) Early 🔥 (More on that later).

A Note… <3

I want to take a moment to highlight the many road blocks for the individuals who are in marginalized communities. There are so many circumstances that are beyond our control. We won’t be able to fix these problems overnight. My hope is that through financial literacy and community, we’ll not only survive but thrive! My hope is that together we'll become financially confident! My hope is that we’ll have the opportunities we want. My hope is that by sharing my story, you’ll feel less alone. <3

If you are struggling, you may meet government/community assistance programs for utilities and food. Check your city services website and local non-profits for programs and rebates.

🔥✨A Gift for You ✨🔥

For MONTHS, I’ve been thinking about creating something to share my savings ideas! I pulled out my dusty journals and scoured my archives looking for all the lists I created during previous saving surges.

Like many, my expenses have skyrocketed and I still have thousands of dollars of medical expenses on the way. I’m trying to prepare as best as I can. I figured some of you may also be interested in some of these ideas!!

So, I present to you, my first ever digital download &&& it’s totally FREE!!!!

Surge Savings Ideas

There are two versions - Same Content but one has a larger print! <3

✨A few notes… ✨

If you have other suggestions on how to make this document more accessible, please let me know! I’ll do my best to make it happen! <3

I’d love it if you shared this blog post within your community!!! Also, I’d love to hear your savings surge ideas on social media!

Check out my posts!!! :)

Disclaimer: Please note, nothing in this post is meant to be medical or financial advice, mk? I’m just sharing what’s worked for me and what I love—not trying to be a doctor or financial planner. You do you, boo—and talk to a pro when you need one. All information provided is for general information only and does not constitute any professional advice. We assume no liability or responsibility for implementation of information contained on this blog. Please talk to a professional. <3

🖤 You’re officially in my Top 8 if you read this far. 🖤

Like, for realzzzs I <3 you. Thanks for being here and supporting my small business!!! Your support means more than you know - whether you shared this post, clicked a link, or giggled at a joke, I’m glad you stopped by! I hope you’ll join me on your next coffee break. <3

<3 <3 <3

HELLLOOOO! Hey! HI! How are ya? I’m Chris! Your friendly neighborhood millennial, neurodivergent, and chronically ill girlie trying to manage life & all its super-duper exciting twists and turns. I hope you enjoy reading & learning with me!.